Best Viewed in PDF version. Click Download below!

Summary

Markets closed the week in the green, supported by positive headlines, but the mood stayed cautious. The muted response to tax reforms and persistent global concerns from tariffs to pressure on IT weighed on sentiment.

For the next bull run to take shape, three things need to align: earnings momentum in Q2 with Nifty EPS moving toward ₹1200, Fed rate cuts that can bring FII flows back to India, and a clear revival in domestic demand.

Until then, optimism in leading indicators must translate into real activity. Autos and metals are leading, banks and financials remain weak, and structural headwinds persist in IT. Against this backdrop, sectors like hospitals, EPC, and power T&D offer strong long-term tailwinds.

We also dive into three key themes: the opportunity in beaten-down banks and financials, how China’s new policies could turn the tide for Indian metals, and why silver might be stepping into gold’s shoes.

Finally, we share our current watchlist — five companies with clear triggers that could drive performance in the months ahead.

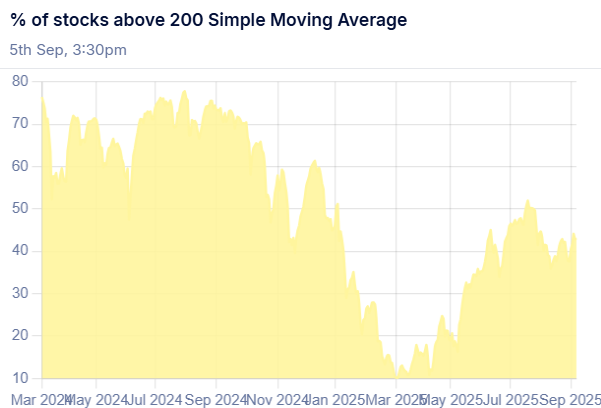

This Past Week

A positive week driven by multiple favorable news, but still falling short of investor expectations due to a muted response to a major tax reform. The weight of geopolitical concerns, including higher tariffs and pressure on the Indian IT/service industry, is proving too heavy for the markets to lift.

We think there are three things the market is still waiting for before the next bull run begins:

- Earnings acceleration in Q2: Broad-based, sector-inclusive growth with Nifty EPS moving toward ₹1200 will provide valuation comfort and improve the attractiveness of Indian markets for global investors, who are currently chasing Japan and Taiwan markets.

- US rate cuts and FII buying: Fed rate cuts will lower interest rates and bond yields, prompting more FII money to flow back into emerging markets like India.

- Domestic demand (GST success): With 60% of GDP consumption-driven, the government has already used most levers – rate cuts, quantitative easing, income tax reductions, and now GST reforms. If this does not revive demand, it will be difficult for investors to regain confidence in India’s growth story.

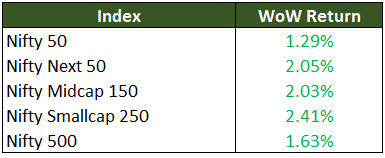

Macros & Markets

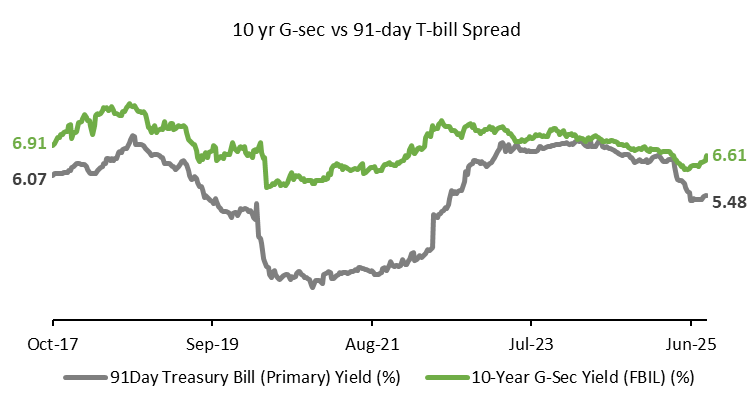

The yield curve spread has widened recently, indicating that expectations are turning positive again. Alongside this, both Manufacturing PMI and Services PMI are at all-time highs. However, more grounded indicators such as two-wheeler sales, non-food credit growth, and freight volumes have not shown a meaningful uptick. A broad-based improvement in these would be a more reliable confirmation that optimism reflected in leading indicators is translating into real economic activity.

In terms of market performance, we are still far from the March 2024 peak, but conditions have improved significantly compared to the lows of April 2025.

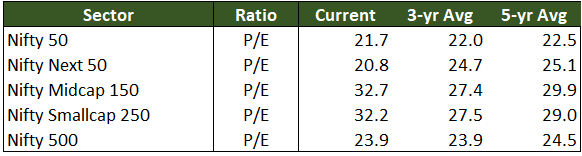

Large-cap valuations have normalized, with some appearing very attractive, while midcaps and smallcaps continue to trade at somewhat extended multiples.

Sector Pulse

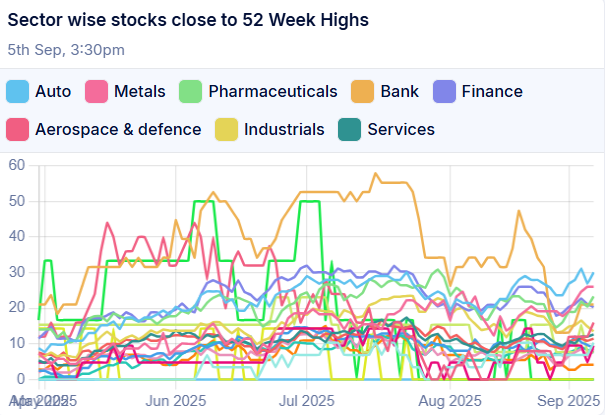

Autos and metals are now leading the rally, both up more than 5% in the last week. Banks and financials have again fizzled out after showing strength earlier. Broad-based credit growth is still weak, and banks continue to face shrinking NIMs driven by low CASA and lower interest rates.

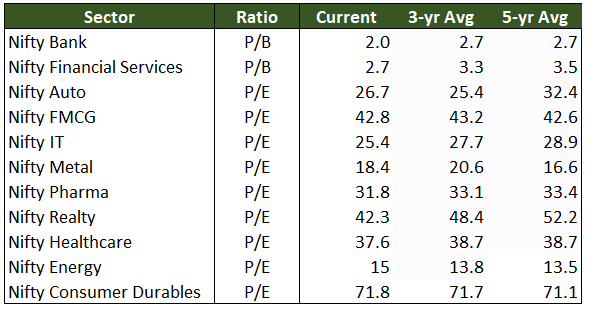

Consumer durables and FMCG performed well, supported by GST optimism, while IT continues to struggle. The Indian IT sector is facing structural headwinds that may not be resolved soon. Banks and financial services are trading at a massive discount, close to COVID-low valuations (more on this later), while valuations in other sectors are normalizing.

Strong Sectors in our Watchlist

Auto – Most companies are passing on GST benefits to end customers. Auto is generally an H2-heavy business. Combine large discounts with the festive season, and you could see pent-up demand unlock, surprising big on the Q3 print. That said, Q2 may be weak as purchases get delayed in anticipation of GST cuts.

Hospitals – Long-term mega tailwinds continue. Capacity addition is ongoing, with many players expanding aggressively. Nearly half the major chains are now PE-owned, and inorganic growth opportunities in this fragmented market remain significant.

EPC – Several companies have order books exceeding 3x current revenue, with management highlighting a strong runway of bidding opportunities, especially in power T&D and public infrastructure. Private capex has just started to pick up and could begin contributing soon.

Power T&D – Benefiting from strong government push on infrastructure and renewable integration. Order books are at multi-year highs across leading players, with visibility extending 2–3 years. The shift toward grid modernization and renewable capacity addition creates a sustained demand cycle for transmission and distribution companies.

Key Themes We’re Tracking

Is this the best opportunity to accumulate Bank and Financial Services?

Banking and financial services are now trading at their COVID-low valuations. The risk-reward looks too attractive to ignore. In a credit-starved economy, unlocking of demand will eventually bring credit growth back, though it is still in single digits (latest data at 10.3%). With one more rate cut expected from the RBI, NIMs may come under pressure again. The theme may not play out over the next two quarters but remains an interesting medium-term opportunity.

What to track: Credit growth numbers, NIM margin improvements in Q2, CASA stabilization

Can China’s anti-involution plan change the fortunes of Indian metal cos?

China controls 54% of global steel production. It recently introduced an anti-involution policy aimed at ending destructive price wars and overcapacity in sectors like coal and steel. As a result, steel production was already down 9.2% YoY in June 2025. India, meanwhile, has imposed a 12% safeguard duty to curb cheap steel imports. Until now, Chinese steel was still cheaper even after the duty. With the anti-involution push, imports may lose their cost advantage, and lower Chinese output could lift global steel prices. Both trends favor Indian producers.

What to track: HRC steel prices (a rise is beneficial), EBITDA/ton improvements among heavyweight players in Q2

Is Silver the next gold?

Silver has hit a 14-year high, with its inflation-adjusted peak still at $54, suggesting more than 30% potential upside. The fundamentals support the move. Around 60% of silver’s demand today is industrial rather than monetary. Solar panels alone consume 20–30g of silver each and could account for 20% of annual supply by 2030. With supply shortages running for five years, prices are finally catching up. Silver could emerge as the next gold.

What to track: Industrial demand growth (solar, electronics), silver mine supply data, and ETF inflows into silver.

Watchlist and Thesis

Finally, the key companies in our watchlist as of 06/09/2025, along with our thesis and triggers that we continue to track.

| Name | Sector | Thesis | Trigger |

| M&M | Auto | Best-positioned in Autos, sales growth back to 20%+; gaining share in SUV segment; can benefit massively from GST and festive season ahead | Growth in the SIAM monthly passenger vehicle data; new product launches |

| Oswal Pumps | Solar Pumps | 35% CAGR industry growth; large TAM; backward integration is a moat giving an edge over the competition; could benefit from GST reduction on pumps | PM KUSUM 2.0 launch and new state-sponsored solar pump programs |

| Zen Technologies | Defence | Differentiated product (anti-drone systems) with huge potential; only 1-2 players with equal technology prowess in the industry; guiding 6000 cr. Revenue in 3 years | Order book weak in Q1, which mgmt describes as temporary; need to assess order book growth in Q2 |

| Yatharth Hospital | Hospitals | Guiding 20%+ topline at 26% EBITDA margins; recently acquired a new hospital in the first expansion beyond NCR region. | Improvements in ROIC in Q2 and higher occupancy rates in mature hospitals |

| Deep Industries | Oil & Gas | 3k cr order book; guiding to grow 30% YoY basis just the existing order book; sticky client contracts; expanding products into renewable energy category | Order book and clientele growth, especially in renewable segment |

Disclaimer

Theory of Compounding is not a SEBI-registered investment advisor. The content here is for informational and educational purposes only and should not be considered financial advice. Please consult a licensed financial advisor before making any investment decisions. We are not responsible for any profits or losses incurred.