Best Viewed in PDF version. Click Download below!

This Past Week

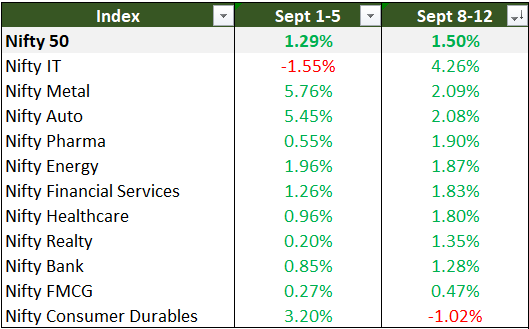

A second week of positive momentum. Though Nifty has had such weeks in the past, the point to note here is the sector-inclusive growth. Almost all sectors rose upwards of 2.0% in the last two weeks.

The three things that we said the market needs to embark on an upward journey still hold.

- Earnings acceleration in Q2: Broad-based, sector-inclusive growth with Nifty EPS moving toward ₹1200

- US rate cuts and FII buying: Fed rate cuts will lower interest rates and bond yields, prompting more FII money to flow back into emerging markets like India.

- Domestic demand (GST success): With 60% of GDP consumption-driven, if GST reforms don’t revive demand, it will be difficult for investors to regain confidence in India’s growth story.

Macros & Markets

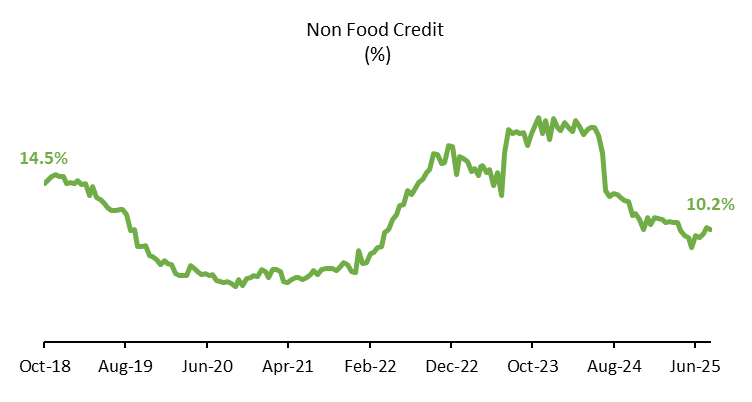

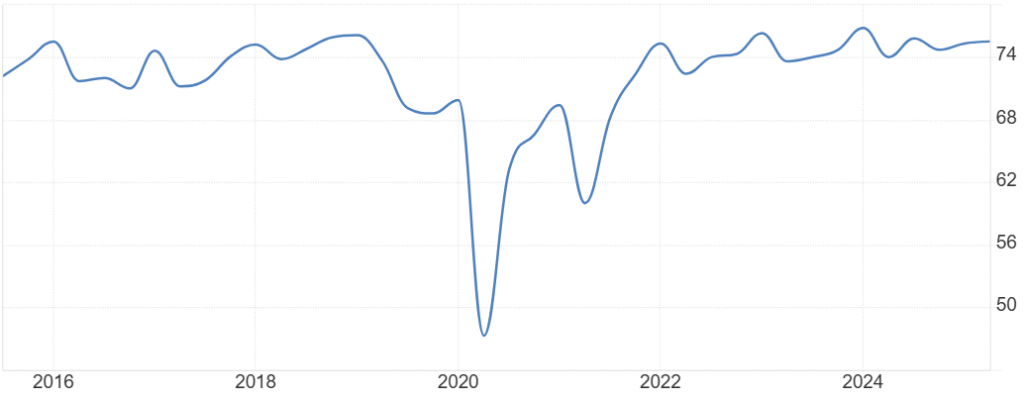

India macros look strongest they’ve looked in a decade. Almost all indicators are positive, with some, like Manufacturing and Services PMI, at all-time highs. Inflation ticked a little higher in August but remains at 5-yr low. Unemployment is at a decadal low. Business confidence, which was at a 4-year low last quarter, jumped 7.4% QoQ to its highest levels in 5 quarters. The only weakness now is in the credit and banking sector.

Credit growth continues to hover around high single digits. As mentioned in last week’s edit, mid-teen to high-teen credit growth is imperative for banks to grow and to support the targeted economic growth.

Apart from credit growth, external factors like tariffs, global slowdown, and trade wars remain against the market. However, being a consumption-driven economy, strong domestic growth could supersede weak external factors.

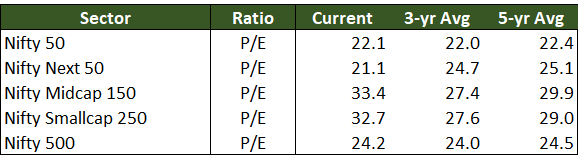

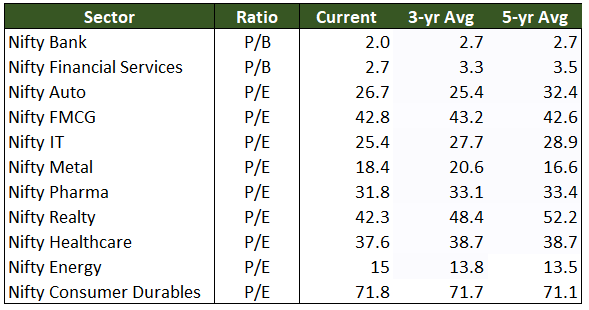

Large-cap valuations have normalized, with some appearing very attractive, while midcaps and smallcaps valuations have grown further away from averages. Midcap and smallcap stocks might need to surprise on the EPS growth to justify the premium.

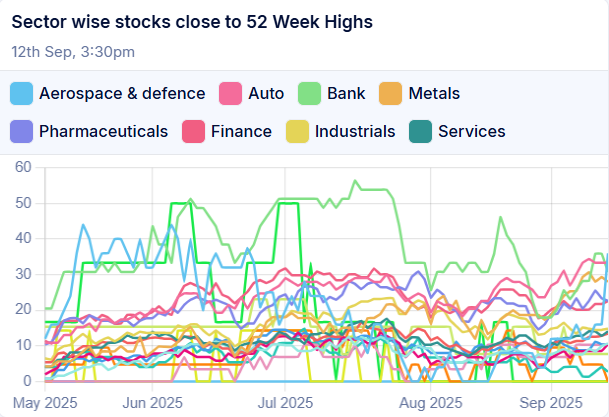

Sector Pulse

Auto and Metal continue to be strong, both up more than 7% in the last two weeks. Two new strong sectors emerged this week: Defense and Banks. Defense made a comeback in the latter half of the week, driven in part by the unveiling of India’s 15-year defense roadmap.

Banks remain an interesting story. Last week, we discussed it as a key theme and a great accumulation opportunity for the medium term. Private banks now look better than public banks.

Pharma is another sector where strength is visible, albeit stock specific and not broad-based like Banks & Metals. IT made a comeback and was the leader of this week, but we remain cautious. Weak rupee is a tailwind for sure, but global IT capex is still weak and even if it’s happening, it’s happening in emerging tech like AI, where Indian IT has limited capabilities, unfortunately.

Strong Sectors in our Watchlist

Continuing:

Auto – Thesis: GST benefit + festive season could surprise earnings, especially Q3, on the upside. (Read full rationale here)

Hospitals – Thesis: Long-term mega tailwinds. Capacity addition is ongoing. Inorganic growth opportunities are significant. (Read full rationale here)

EPC – Thesis: Many order books at all-time highs with significant runway for growth. Private capex could boost further. (Read full rationale here)

Power T&D – Thesis: Strong push on infrastructure and renewable integration. Order books are at multi-year highs with visibility extending 2–3 years. (Read full rationale here)

New:

None added.

Key Themes We’re Tracking

Is Private Capex Making a Comeback?

The long-awaited private capex revival is showing its strongest signs, and the case is compelling. 1) Capacity utilization is now over 75% for the last 2 quarters (first time after Q1 2019). This generally triggers new capex. 2) Corporate balance sheets are the healthiest they’ve been in a decade, allowing for expansions. 3) Govt. focus on manufacturing and multiple PLI schemes act as a catalyst.

What to track: Order inflows of capital goods & EPC companies (L&T), growth in industrial bank credit, and management commentary on capex plans in Q2

Is this the best opportunity to accumulate Bank and Financial Services?

Banking and financial services are now trading at their COVID-low valuations. The risk-reward looks too attractive to ignore. In a credit-starved economy, unlocking of demand will eventually bring credit growth back, though it is still in single digits (latest data at 10.2%). With one more rate cut expected from the RBI, NIMs may come under pressure again. The theme may not play out over the next two quarters but remains an interesting medium-term opportunity.

What to track: Credit growth numbers, NIM margin improvements in Q2, CASA stabilization

Can China’s anti-involution plan change the fortunes of Indian metal cos?

China controls 54% of global steel production. It recently introduced an anti-involution policy aimed at ending destructive price wars and overcapacity in sectors like coal and steel. As a result, steel production was already down 9.2% YoY in June 2025. India, meanwhile, has imposed a 12% safeguard duty to curb cheap steel imports. Until now, Chinese steel was still cheaper even after the duty. With the anti-involution push, imports may lose their cost advantage, and lower Chinese output could lift global steel prices. Both trends favor Indian producers.

What to track: HRC steel prices (a rise is beneficial), EBITDA/ton improvements among heavyweight players in Q2

Is Silver the next gold?

Silver has hit a 14-year high, with its inflation-adjusted peak still at $54, suggesting more than 30% potential upside. The fundamentals support the move. Around 60% of silver’s demand today is industrial rather than monetary. Solar panels alone consume 20–30g of silver each and could account for 20% of annual supply by 2030. With supply shortages running for five years, prices are finally catching up. Silver could emerge as the next gold.

What to track: Industrial demand growth (solar, electronics), silver mine supply data, and ETF inflows into silver.

Watchlist and Thesis

Finally, the key companies in our watchlist as of 13/09/2025, along with our thesis and triggers that we continue to track.

| Name | Sector | Thesis | Trigger |

| M&M | Auto | Best-positioned in Autos, sales growth back to 20%+; gaining share in SUV segment; can benefit massively from GST and festive season ahead | Growth in the SIAM monthly passenger vehicle data; new product launches |

| Oswal Pumps | Solar Pumps | 35% CAGR industry growth; large TAM; backward integration is a moat giving an edge over the competition; could benefit from GST reduction on pumps | PM KUSUM 2.0 launch and new state-sponsored solar pump programs |

| Zen Technologies | Defence | Differentiated product (anti-drone systems) with huge potential; only 1-2 players with equal technology prowess in the industry; guiding 6000 cr. Revenue in 3 years | Order book weak in Q1, which mgmt describes as temporary; need to assess order book growth in Q2 |

| Yatharth Hospital | Hospitals | Guiding 20%+ topline at 26% EBITDA margins; recently acquired a new hospital in the first expansion beyond NCR region. | Improvements in ROIC in Q2 and higher occupancy rates in mature hospitals |

| Deep Industries | Oil & Gas | 3k cr order book; guiding to grow 30% YoY basis just the existing order book; sticky client contracts; expanding products into renewable energy category | Order book and clientele growth, especially in the renewable segment |

Disclaimer

Theory of Compounding is not a SEBI-registered investment advisor. The content here is for informational and educational purposes only and should not be considered financial advice. Please consult a licensed financial advisor before making any investment decisions. We are not responsible for any profits or losses incurred.