Banking Leads, IT and FMCG Falter

Banking on the Banks: Weekly Sectoral Pulse of the Indian Market

Every week, the market reveals where the money is going — and more importantly, where it’s leaving.

This week, even as the benchmark indices dipped, the FMCG sector emerged as the best performing sector in India, rising +2.15%. But beneath the surface, the action tells a deeper story.

Let’s decode what sectors are showing growth momentum — and which ones are flashing red.

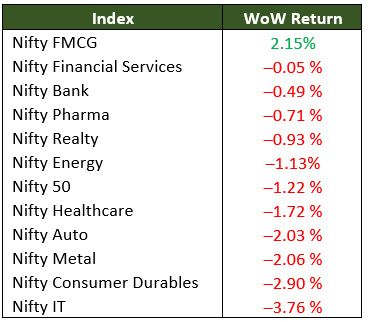

📈 Weekly Sector Performance Snapshot

🏆 Best Performing Sector in India This Week: FMCG

Despite a weak broader market, FMCG stocks gained +2.15%, thanks to:

- Defensive buying during uncertain market conditions

- Hints of rural demand stabilizing

- Off-season consumption bump and input cost support

But this rally may not last. Fundamentals like muted volume growth, low margins, and rural drag still weigh heavily on the sector. Valuations also remain elevated.

So, while FMCG was the best performing sector this week, it’s not the top growth sector in India from a medium- to long-term investing standpoint.

📉 Biggest Laggards: IT, Consumer Durables, Metals

- IT (-3.76%): Hit hardest. Global macro headwinds continue, with weak discretionary tech spending, hiring freezes, and no near-term catalysts.

- Consumer Durables (-2.90%): Profit booking kicked in amid fading demand signals in the discretionary category.

- Metals (-2.06%) & Auto (-2.03%): Corrected on global cues, high base effect, and profit-taking after a strong run.

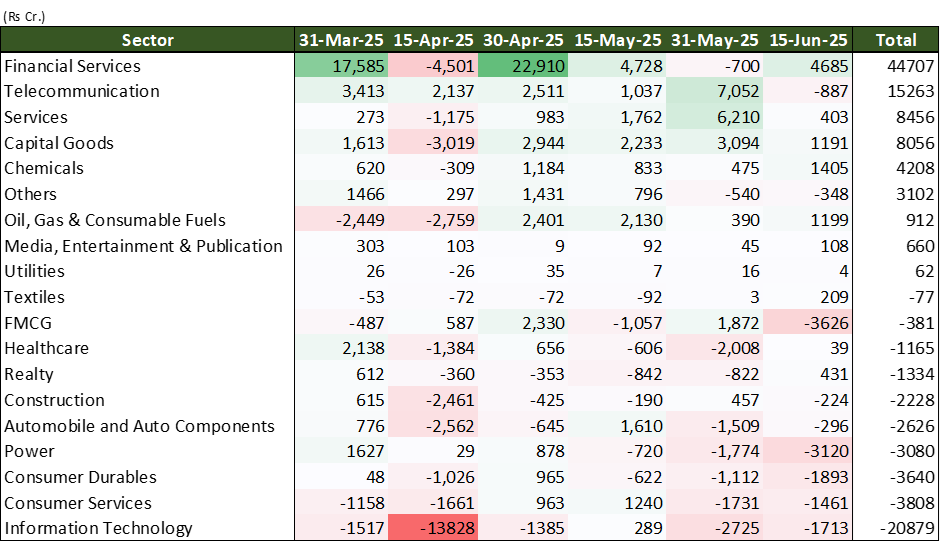

💰 Where Did the Money Flow This Week?

📍 Foreign Portfolio Investors (FPIs) are getting selective. Here’s where they’re positioning:

Inflow sectors:

- Credit: Banks and NBFCs

- Capex: Infra, capital goods, and manufacturing

- Cashflow-rich plays: Energy, telecom

Outflow sectors:

- Consumer & IT: Exit queues are growing as demand visibility weakens

- FMCG & Realty: Profit-taking as valuations stretch

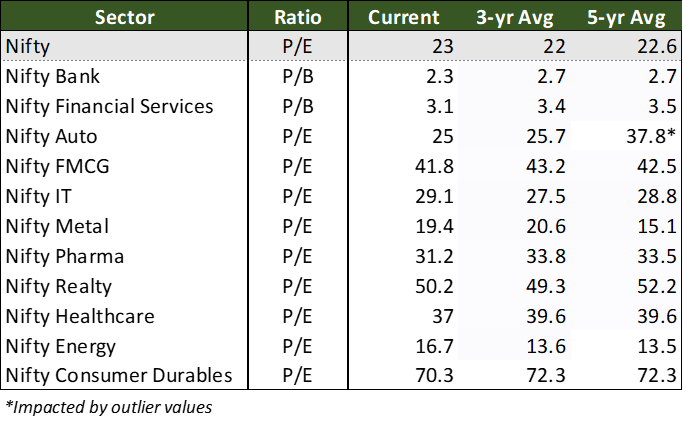

🔍 Valuation Check: What’s Cheap, What’s Not

- 🏦 Banks & Financial Services: Still undervalued despite credit growth. RBI’s liquidity stance + potential rate cuts make this a strong medium-term play.

- ⚡ Energy: Multiples expanding, but supported by multi-year tailwinds in renewables and national energy security capex.

- 💻 IT, FMCG, Realty: Feeling valuation fatigue. Pricing already reflects optimism not backed by fundamentals.

🏅 Top 3 Growth Sectors in India Right Now

Based on growth visibility, FPI positioning, and sector fundamentals, here are the top picks:

🏦 1. Banking and Financial Services

India’s credit engine is humming:

- Credit growth at ~16% YoY

- Gross NPAs under control

- Capex lending demand rising

- RBI’s liquidity support + rate cut hopes could attract FII inflows

Banks are not only growing earnings but also re-rating candidates, making this the strongest growth sector in India at the moment.

🏗 2. Capital Goods and Infra

India is not running on consumption — it’s being driven by capex:

- Government infra outlay reaching execution stage

- Private capex revival underway

- Operating leverage visible across equipment and EPC companies

- PLI scheme driving order flows in domestic manufacturing

This sector benefits from policy + macro + earnings — the golden trio.

📡 3. Telecom

A stealth growth story, telecom is re-emerging as a structural play:

- Duopoly market structure (Jio + Airtel) means pricing power

- ARPUs rising steadily

- Data usage doubling every 2 years

- Capex cycle maturing, which means better cash flows ahead

With rising penetration of 5G and premium plans, this space offers both cash flow stability and growth.

🚨 Bottom 2 Sectors to Watch Out

🧴 FMCG

Despite this week’s gains, the sector faces structural issues:

- Stagnant volume growth

- Paper-thin margins

- Rural recovery still fragile

- Premium valuations, despite slowing fundamentals

💻 IT

The worst performer this week — and not without reason:

- Global discretionary tech spends under pressure

- Hiring freezes and client conservatism persist

- No significant product IP differentiation in most Indian firms

- Valuations still high relative to growth visibility

Investors need to be selective. Pick only the highest-quality companies with deep client relationships and diversified revenue.

Liked this piece?

📩 Subscribe to Theory of Compounding for deep, actionable insights on long-term investing in India.