Best Viewed in PDF version. Click Download below!

The Data Center Market

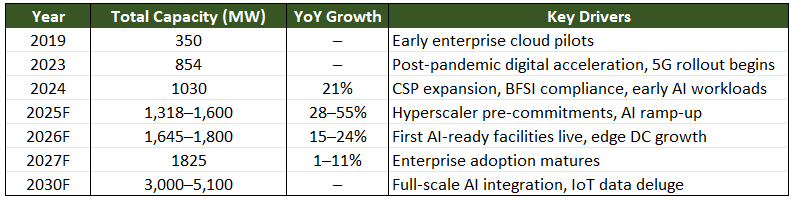

India’s data centre (DC) industry has moved from a niche to a strategic national asset. Installed IT load crossed 1.03 GW in 2024, up nearly 3x from 350 MW in 2019, implying a 24% CAGR.

By 2030, consensus sees 3–5 GW of IT load and USD 20–25 billion in cumulative investments.

Table 1: Forecasted data center capacity in India

Demand Drivers:

1. Hyperscaler Cloud Expansion (AWS, Azure, Google Cloud)

- Already account for ~54% of absorption (2024).

- Long-term commitments (multi-MW pre-leases) create revenue visibility.

2. BFSI & Regulatory Compliance

- BFSI contributes ~18% of demand

- RBI and DPDP Act 2023 mandate data localization, structurally anchoring domestic DC demand

3. AI & High-Performance Computing (HPC)

- Cloud providers in India have already pre-committed ~800 MW for AI workloads

- AI racks require 50–150 kW/rack vs the global legacy average of 12 kW

- By 2030, 40–50% of India’s DC capacity will be AI/GPU workloads

. - This drives a capex shift toward liquid cooling, high-density power, and AI-ready campuses

4. 5G & IoT Adoption

- Over 900m mobile users, cheapest data globally, and rural internet penetration (~56% of new users) create a surge in data volumes

- 5G + IoT proliferation pushes both hyperscale campuses (Mumbai/Chennai) and edge DCs (tier-2/3 cities) for low-latency needs

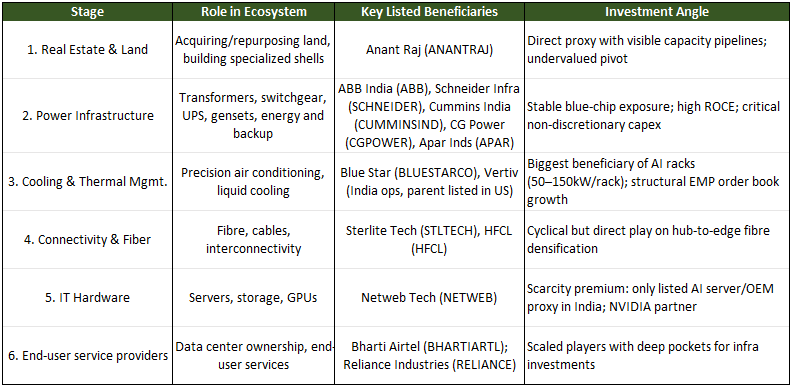

Value Chain & Beneficiaries

India’s data centre (DC) expansion is not a monolithic “real estate + servers” story. It is a multi-layered value chain where downstream enablers often capture more durable cash flows than the operators themselves. The ecosystem can be segmented into six critical stages:

Table 2: Listed Players in Value Chain

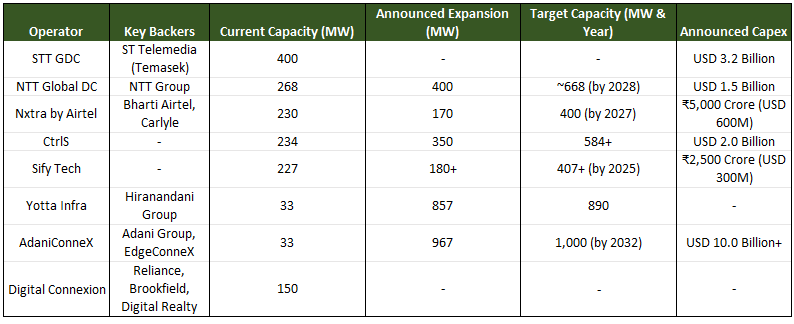

Announced Capex

Near-term investment is estimated at USD 5.7 billion to USD 5.8 billion by 2026-2. USD 1.1 billion is allocated for civil construction (the physical building), while a much larger USD 4.5 billion is required for the complex Mechanical, Electrical, and Plumbing (MEP) systems that form the technical heart of the facility.24 Longer-term capital expenditure forecasts are even more substantial, with estimates ranging from USD 20-25 billion over the next five to six years to as high as USD 30 billion by 2030.

Table 3: Announced Capex by Key Players

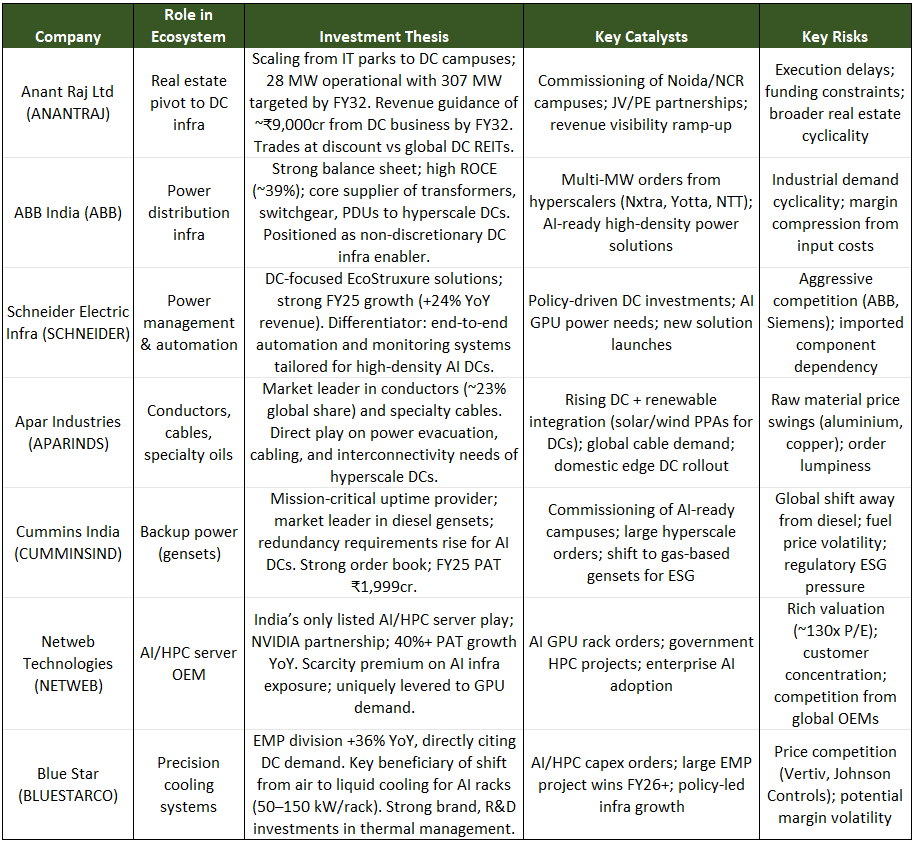

Our Shortlist of Key Stocks

Our list of key enablers in the space with good tailwinds, significant exposure to the space, and high growth potential

Table 4: Shortlist of Key Data Center Stocks

Key Risks and Challenges

Policy execution: Delays in land, power, or state-level clearances could slow project commissioning.

Technology shifts: Rapid move to liquid cooling and GPU-heavy workloads may outpace firms like Blue Star or Netweb if they don’t adapt.

Financial stretch: Heavy capex burdens balance sheets (Anant Raj, Apar); Netweb trades at rich valuations (>100x P/E).

ESG headwinds: Diesel gensets (Cummins) face long-term decarbonisation risk.

Competition: Global MNCs (Siemens, Vertiv, Equinix) intensify price and technology competition.

Update on Our Strong Sectors:

Continuing:

Auto – Thesis: GST benefit + festive season could surprise earnings, especially Q3, on the upside. (Read full rationale here)

Hospitals – Thesis: Long-term mega tailwinds. Capacity addition is ongoing. Inorganic growth opportunities are significant. (Read full rationale here)

EPC – Thesis: Many order books at all-time highs with significant runway for growth. Private capex could boost further. (Read full rationale here)

Power T&D – Thesis: Strong push on infrastructure and renewable integration. Order books are at multi-year highs with visibility extending 2–3 years. (Read full rationale here)

New:

None

Update on themes:

Is this the best opportunity to accumulate Bank and Financial Services?

Read the thesis here

Update: Looks stronger than before. Might surprise sooner than expected. Trigger remains growth in credit and NIM expansion.

Can China’s anti-involution plan change the fortunes of Indian metal cos?

Read the thesis here

Update: Steel prices are slightly up since last month. Theme can play out if Indian players report EBITDA/ton expansion in Q2

Is Silver the next gold?

Read the thesis here

Update: Long-term theme. Remains strong. It could be $50 in a few months.

Disclaimer

Theory of Compounding is not a SEBI-registered investment advisor. The content here is for informational and educational purposes only and should not be considered financial advice. Please consult a licensed financial advisor before making any investment decisions. We are not responsible for any profits or losses incurred.